The 100 billion dollar question around Wall Street is and always will be, 'What is the next bubble?' In 2000 it was the .com boom that saw the NASDAQ rise to over 4,000 points. In the mid 2000's it was the real estate explosion that eventually led to the sub-prime mortgage collapse and the recession. If you ask most investment minded people today what they think the next bubble is, a large percentage would likely tell you that it's the social media .com bubble, and it's already forming. With the enormous valuations of Facebook and Groupon (both private for the time being), this claim is hard to argue with.

In this series of posts, I will try to quantify IF, and how much, this bubble is really inflating. We will use three measures taken with data over the last two years:

1. A side-by-side comparison of the stocks performance vs. the NASDAQ

2. The difference in percent change the stock price and the NASDAQ

3. A momentum measure defined as:

Momentum = daily relative change in stock price* daily relative volume,

then taken as a 50 day moving average.

Any momentum > 0 suggest higher prices on higher volumes and any momentum < 0 suggests lower prices on higher volumes.

These three measures will give us a good idea of how quickly these stock prices are inflating in comparison to others, as well as the overall buying/selling sentiment in the stock.

I encourage readers to suggest additional measures if they have any good ideas.

We begin with three of the biggest players in the field; Apple, Google, and Sina Corp.

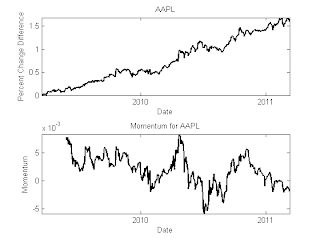

Apple (

aapl) is an interesting case because it is not directly involved social media. Instead they build the hardware (ipads, iphones, itouches, itunes) that social media would be much smaller without. Nonetheless, the two are intricately related, and Apple is undoubtedly at the forefront of this field.

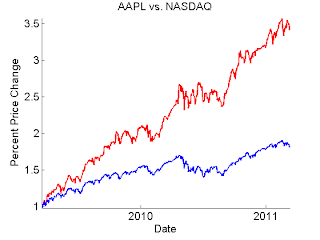

The direct comparison of Apple (red) and the NASDAQ (blue) is well known, Apple has been a market leader since the end of the recession.

What's even more impressive is that the difference between the two (top plot) has been steadily increasing as well, indicating that appl is further separating itself from the market. One worrysome indicator however, is that the momentum (bottom plot) has temporarily dipped below 0, possibly indicating a pullback in aapl stock.

_________________

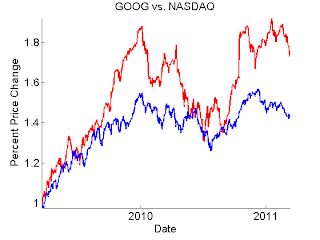

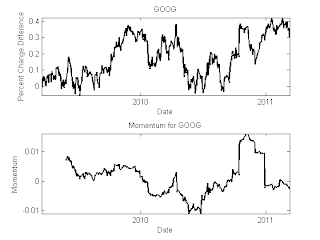

Next up is Google (

goog), a major company that is primed to reap the benefits of social media, but has barely gotten its feet wet yet. Sure, the Android is a fine competitor to the iphone but a single device is likely not enough. Still, Google's failed buyout of Groupon last year shows that they definitely want in. Check out

GoogleMe and stay tuned...more to come later on that.

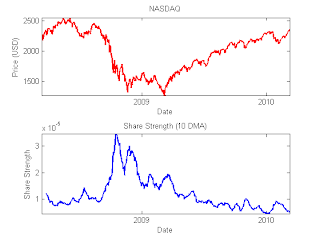

The same analysis of Google shows a much more wild ride over the past two years,

Google (red) NASDAQ (blue)

where we definitely don't see the bubblicious qualities that marked Apple, but its performance is still impressive. This is perhaps an excellent indicator however of Google's lack of exposure to the social media market. But stay tuned, Google may be hopping on the train very soon.

_________________

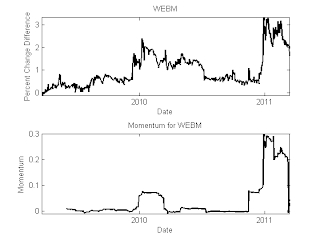

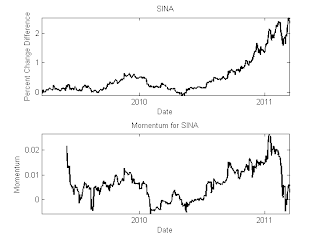

Finally we come to Sina Corp. (

sina) which runs a Twitter-like operation in China.

Sina's performance is impressive, with a divergence from NASDAQ more than twice that of Apple's, and growing. Sina's momentum is also impressive (except for the past month), with a momentum peaking at 4 times that of Apple's. Sina's stock price is going exponential, the tell-tale sign of a bubble, but with no end in site yet.

From this snapshot, we can clearly see that, with the big boys, the bubble is surely forming. But three companies do not make a complete picture and there is a lot more left to study. Part 2 of this series will cover smaller-cap stocks that are more exposed to the social media market.